2024-03-07

Por +Factos

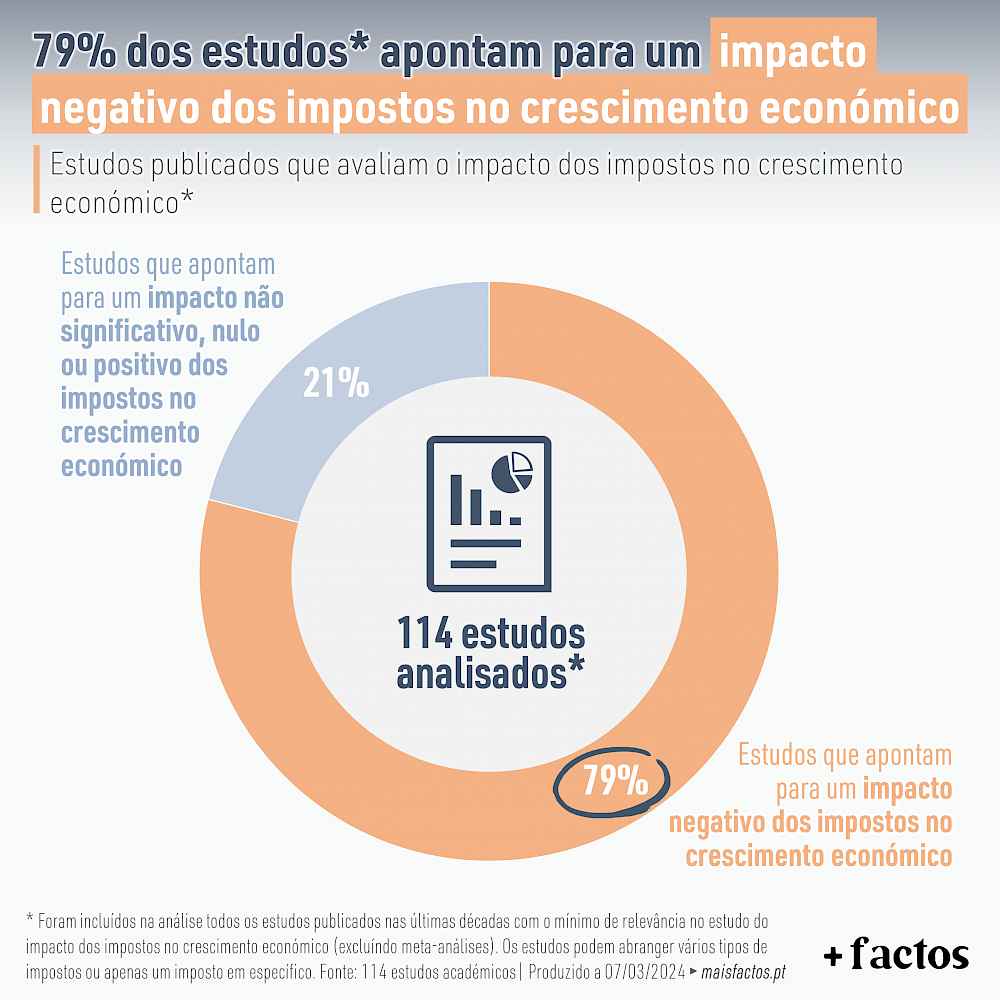

Impacto negativo dos impostos no crescimento económico

Será que os impostos introduzem um entrave ao crescimento económico?

Apesar de não existir consenso absoluto, a maioria dos estudos demonstra que sim. O equilíbrio entre o peso do Estado Social e a liberdade económica é um desafio das sociedades desenvolvidas.

Foram analisados mais de 100 estudos publicados nas últimas décadas com o mínimo de relevância no estudo do impacto dos impostos no crescimento económico (excluindo meta-análises). Cerca de 80% desses estudos apontam para um impacto negativo dos impostos no crescimento económico. Ou seja, em maior ou menor escala, os impostos acabam por ser um entrave ao crescimento económico.

Apenas 20% dos estudos apontam para um impacto não significativo, nulo ou positivo dos impostos no crescimento económico.

Nota: Os estudos abrangem vários tipos de impostos ou apenas um imposto em específico.

Lista de estudos analisados:

Lista de estudos analisados:

- Acosta-Ormaechea, S., Yoo, J. (2012): "Tax composition and growth: a broad cross-country perspective", IMF Working Paper No. 12/257.

- Agell, J., Ohlsson, H., Skogman Thoursie, P. (2003): “Growth effects of government expenditure and taxation in rich countries: A comment,” European Economic Review.

- Akgun, O., Cournede, B., Fournier, J. (2017): "The effects of the tax mix on inequality and growth", OECD Economics Department Working Paper No. 1447.

- Alesina, A., Ardagna, S. (2010): "Large Changes in Fiscal Policy: Taxes versus Spending", Tax Policy and the Economy, 24, 35-68, National Bureau of Economic Research, Inc.

- Alesina, A. et al. (1999): "Fiscal Policy, Profits and Investment". National Bureau of Economic Research. Working Paper No. 7207.

- Alfò, M., Carbonari, L., Trovato, G. (2022): "On the Effects of Taxation on Growth: an Empirical Assessment", Working Paper series 22-06, Rimini Centre for Economic Analysis.

- Alm, J., Rogers, J. (2011): "Do state fiscal policies affect state economic growth?", Public Finance Review, 39(4), 483-526.

- Angelopoulos, K., Economides, G., Kammas, P. (2007): "Tax-spending policies and economic growth: Theoretical predictions and evidence from the OECD", European Journal of Political Economy, 23(4), 885-902.

- Arnold, J. (2008): "Do tax structures affect aggregate economic growth? Empirical evidence from a panel of OECD countries", OECD Economics Department Working Papers No. 643.

- Arnold, J., Brys, B., Heady, C., Johansson, A., Schwellnus, C., Vartia, L. (2011): "Tax policy for economic recovery and growth", Economic Journal, 121(550), F59-F80.

- Bakija, J., Narasimhan, T. (2015): "Effects of the level and structure of taxes on long-run economic growth: what can we learn from panel time-series techniques?", Proceedings. Annual Conference on Taxation and Minutes of the Annual Meeting of the National Tax Association, 108, 1-57.

- Balasoiu, N., Chifu, I., Oancea, M. (2023): "Impact of Direct Taxation on Economic Growth: Empirical Evidence Based on Panel Data Regression Analysis at the Level of Eu Countries", Sustainability, MDPI, vol. 15(9), 1-32, April.

- Bania, N., Gray, J.A., Stone J.A. (2007): "Growth, taxes, and government expenditures: growth hills for U.S. states", National Tax Journal 60, 193-204.

- Barro, R. (1990): "Government Spending in a Simple Model of Endogenous Growth". Journal of Political Economy, 98, 103-125. https://doi.org/10.1086/261726

- Barro, R.J., Redlick, C.J. (2011): "Macroeconomic Effects From Government Purchases and Taxes", The Quarterly Journal of Economics, vol. 126(1), 51-102.

- Becker, J. (2009): "Taxation of Foreign Profits with Heterogeneous Multinational Firms". Center for Economic Studies. Working Paper No. 2889.

- Benos, N. (2009): "Fiscal policy and economic growth: empirical evidence from EU countries".

- Blanchard, O., Perotti, R. (2002): "An Empirical Characterization Of The Dynamic Effects Of Changes In Government Spending And Taxes On Output", Quarterly Journal of Economics 107, 1329-1368.

- Blanco, F., Delgado, F. (2019): "Taxation and economic growth in the European Union: A quantile approach", Revista de Economia Mundial, 51, 79-100.

- Bleaney, M., Gemmell, N., Kneller, R. (2001): "Testing the endogenous growth model: public expenditure, taxation, and growth over the long run", Canadian Journal of Economics 34, 36-57.

- Bretschger, L. (2010): Taxes, mobile capital, and economic dynamics in a globalizing world, Journal of Macroeconomics, 32(2), 594-605.

- Chernick, H., Tax progressivity and state economic performance, 11 Economic Development Quarterly 249-267 (1997).

- Cloyne et al., 2018, “Taxes and Growth: New Narrative Evidence from Interwar Britain,” NBER Working Paper 24659.

- Cloyne, J. (2013): "Discretionary Tax Changes and the Macroeconomy: New Narrative Evidence from the United Kingdom", American Economic Review, 103 (4), 1507-28.

- Cloyne, J., Martinez, J., Mumtaz, H., Surico, P. (2022): "Short-Term Tax Cuts, Long-Term Stimulus", NBER Working Papers 30246, National Bureau of Economic Research, Inc.

- Dackehag, M., Hansson, A. (2012): "Taxation of income and economic growth: an empirical analysis of 25 rich OECD countries", Lund University Department of Economics Working Paper No. 2012/6.

- Dalgaard, C., Kreiner, C.T. (2003): "Endogenous Growth: A Knife Edge or the Razor's Edge?" Scandinavian Journal of Economics, Wiley Blackwell, vol. 105(1), 73-86, March.

- Daveri, F., Tabellini, G. (2001): "Unemployment, Growth and Taxation in Industrial Countries". Economic Policy 30 (4), 47-104.

- Denaux, Z., Walden, M. (2004): "Complete State and Local Fiscal Policy: Impacts on Local Economic Growth", The Southern Business and Economic Journal 27, 154–71.

- Denaux, Z. (2007): "Endogenous growth, taxes and government spending: theory and evidence", Review of Development Economics, 11(1), 124-138.

- Drucker, L., Krill, Z., Geva, A. (2017): "The Impact of Tax Composition on Income Inequality and Economic Growth", mimeo.

- Durusu-Ciftci, D., Gokmenoglu, K., Yetkiner, H. (2018): "The heterogeneous impact of taxation on economic development: new insights from a panel cointegration approach", Economic Systems, 42(3), 503-513.

- Easterly, W., Rebelo, S., Fiscal Policy and Economic Growth: An Empirical Investigation, 32 Journal of Monetary Economics 417-458 (1993).

- Eneche Onoja, Emmanuel & Stephen, Ibrahim. (2020). Tax Revenue and Nigeria Economic Growth. European Journal of Social Sciences. 3. 30. 10.26417/ejss.v3i1.p30-44.

- Engen, Eric M., Skinner, Jonathan (1996): "Taxation and Economic Growth", NBER Working Papers 5826, National Bureau of Economic Research, Inc.

- Feldstein, M., Wrobel, M. V. (1998): "Can state taxes redistribute income?," Journal of Public Economics 68(3), 369-396, June.

- Ferede, E., Dahlby, B. (2012): "The impact of tax cuts on economic growth: evidence from the Canadian provinces", National Tax Journal 65(3), 563-594.

- Folster, S., Henrekson, M. (2001): "Growth effects of government expenditure and taxation in rich countries," European Economic Review 45, 1501-1520.

- Forbin, E. (2011): "Effects of corporate taxes on economic growth: the case of Sweden", Jönkoping University.

- Furceri, D., Karras, G. Tax changes and economic growth : Empirical evidence for a panel of OECD countries

- International Monetary Fund, Will it hurt? Macroeconomic effects of fiscal consolidation, in World Economic Outlook: Recovery, Risk, and Rebalancing (2010).

- Jaimovich, N., Rebelo, S. (2017): "Nonlinear Effects of Taxation on Growth", Journal of Political Economy 125(1), 265-291.

- Jentsch, C., Lunsford, K.G. (2019): "The Dynamic Effects of Personal and Corporate Income Tax Changes in the United States: Comment", American Economic Review 109 (7), 2655-78.

- Johansson, Åsa; Heady, Christopher; Arnold, Jens; Brys, Bert; Vartia, Laura. (2008): "Taxation and Economic Growth", OECD Economics Department Working Papers. 10.1787/241216205486.

- Jungsuk Kim; Mengxi Wang; Donghyun Park; Cynthia Castillejos Petalcorin (2021): "Fiscal policy and economic growth: some evidence from China", Review of World Economics (Weltwirtschaftliches Archiv) 157(3), 555-582, August.

- Gale, W., Krupkin, A., Rueben, K. (2015): The relationship between taxes and growth at the state level: new evidence, National Tax Journal, 68(4), 919-942.

- Gale, William G. and Samwick, Andrew A., Effects of Income Tax Changes on Economic Growth (September 9, 2014). Available at SSRN: https://ssrn.com/abstract=2494468 or http://dx.doi.org/10.2139/ssrn.2494468

- Gemmell, N., Kneller, R., Sanz, I. (2014): The growth effects of tax rates in the OECD, Canadian Journal of Economics, 47(4), 1217-1255.

- Gemmell, N., Kneller, R., Sanz, I., The Timing and Persistence of Fiscal Policy Impacts on Growth: Evidence from OECD Countries, 121 Economic Journal F33-F58 (2011).

- Gentry, W. M., Hubbard, R. G. (2004): "The effects of progressive income taxation on job turnover", Journal of Public Economics 88(11), 2301-2322, September.

- Gil, P., Martí, F., Morris, R. et al. The output effects of tax changes: narrative evidence from Spain. SERIEs 10, 1–23 (2019). https://doi.org/10.1007/s13209-018-0173-5

- Godar, S., Paetz, C., Truger, A. (2015): "The scope for progressive tax reform in the OECD countries. A macroeconomic perspective with a case study for Germany", Revue de l'OFCE 141(5), pages 79-117.

- Goetz, S., Partridge, M., Rickman, M., Rickman, D., Majumdar, S. (2011): Sharing the gains of local economic growth: race-to-the-top versus race-to-the-bottom economic development, Environment and Planning C: Government and Policy, 29, 428-456.

- Goff, B., Lebedinsky, A., Lile, S. (2012): A matched pairs analysis of state growth differences, Contemporary Economic Policy, 30(2), 293-305.

- Gravelle, J., Marples, D.J.. (2013). Tax rates and economic growth. Tax Rates: Economic Effects and Implications. 23-36.

- Grdinic, M., Drezgic, S., Blazic, H. (2017): An empirical analysis of the relationship between tax structures and economic growth in CEE countries, Ekonomicky casopis, 65(5), 426-447.

- Gunter et al., 2019, “Non-linear Effects of Tax Changes on Output: The Role of the Initial Level of Taxation,” NBER Working Paper 26570.

- Hayo, B. and M. Uhl (2014): “The macroeconomic effects of legislated tax changes in Germany,” Oxford Economic Papers, 66.

- Helms, J., The effect of state and local taxes on economic growth: a time series-cross section approach, 67 Review of Economics and Statistics 574-582 (1985).

- Holcombe, R., Lacombe, D., The effect of state income taxation on per capita income growth, 32 Public Finance Review 292-312 (2004).

- Honest, M.M. (2020): "Tax revenue and economic growth in developing country: an autoregressive distribution lags approach," Central European Economic Journal 7(54), 205-217, January.

- Ho, T.T., Tran, X.H., Nguyen, Q.K. (2023) Tax revenue-economic growth relationship and the role of trade openness in developing countries, Cogent Business & Management, 10:2, DOI: 10.1080/23311975.2023.2213959

- Hunady, J., Orviska, M. (2015): The non-linear effect of corporate taxes on economic growth, Timisoara Journal of Economics and Business, 8(1), 14-31

- Hungerford, T. (2013): Corporate tax rates and economic growth since 1947, Economic Policy Institute Issue Brief No. 364.

- Hungerford, T. (2018): Latest tax cuts: history belies promise of growth, Challenge, 61(2), 109-119.

- Hussain, Syed M. & Liu, Lin (2023): "Macroeconomic effects of government spending shocks: New narrative evidence from Canada", Journal of Macroeconomics 75(C).

- Katz, C.J., Mahler, V.A., Franz, M.G., The impact of taxes on growth and distribution in developed capitalist countries: a cross-national study, 77 American Political Science Review 871-886 (1983).

- King, R., Rebelo, S. (1990): "Public Policy and Economic Growth: Developing Neoclassical Implications." Journal of Political Economy 98 (5), 126-150.

- Kneller, R., Bleaney, M., Gemmell, N. (1999). Fiscal Policy and Growth: Evidence from OECD Countries. Journal of Public Economics. 74. 171-190. 10.1016/S0047-2727(99)00022-5.

- Koester, R., Kormendi, R., Taxation, Aggregate Activity and Economic Growth: Cross-Country Evidence on Some Supply-Side Hypotheses, 27 Economic Inquiry 367-86 (1989).

- Lee, Y., Gordon, R. (2005): Tax structure and economic growth, Journal of Public Economics, 89(5-6), 1027-1043.

- Liu, Y., Martinez-Vazquez, J. (2015): Growth-inequality tradeoff in the design of tax structure: evidence from a large panel of countries, Pacific Economic Review, 20(2), 323-345.

- Ljungqvist, A., Smolyansky, M., 2018, “To Cut or Not to Cut? On The Impact of Corporate Taxes on Employment and Income.” NBER Working Paper 20753.

- Macek, R. (2014): The impact of taxation on economic growth: case study of OECD countries, Review of Economic Perspectives, 14(4), 309-328.

- Macnamara,P., Pidkuyko, M., Rossi, R. (2021): "Marginal Tax Rates and Income in the Long Run: Evidence from a Structural Estimation", Economics Discussion Paper Series 2105, The University of Manchester, revisto Jan 2022.

- Mañas-Antón, Luis (1986): "Relationship between Income Tax Ratios and Growth Rates in Developing Countries: A Cross-Country Analysis". IMF Working Paper No. 86/7, https://ssrn.com/abstract=884545

- Mak, A., Rudra, P., Mahendhiran, N. (2021): "Are there links between institutional quality, Government expenditure, Tax revenue and economic growth? Evidence from low-income and lower middle-income countries." Economic Analysis and Policy. 70. 10.1016/j.eap.2021.03.011.

- Marsden, K., "Links between taxes and economic growth: some empirical evidence", Staff working paper no 605, The World Bank. http://documents.worldbank.org/curated/en/447031468756620681

- Martinez-Vazquez, J., Vulovic, V. (2014): "Tax structure in Latin America: its impact on the real economy", Revista de Economia Mundial, 37, 41-73.

- McNabb, K., LeMay-Boucher, P. (2014): "Tax Structures, Economic Growth and Development", ICTD Working Paper, No. 22.

- McNabb, K. (2018): "Tax structures and economic growth: new evidence from the government revenue dataset", Journal of International Development, 30(2), 173-205.

- McPhail, J., Orazem, P., Singh, R., (2012). "The Poverty of States: Do State Tax Policies Affect State Labor Productivity?", SU General Staff Papers 201207010700001114, Iowa State University.

- Mendoza, E., Milesi-Ferretti, G., Asea, P. (1997): "On the Effectiveness of Tax Policy in Altering Long-Run Growth: Harberger’s Superneutrality Conjecture", Journal of Public Economics 66, 99-126.

- Mertens, K., Olea, J.L., 2018, “Marginal Tax Rates and Income: New Time Series Evidence,” Quarterly Journal of Economics 133(4), 1803-84.

- Mertens, K., Ravn, M.O. (2013): "The Dynamic Effects of Personal and Corporate Income Tax Changes in the United States," American Economic Review 103(4), 1212-1247, June.

- Mertens, K., Ravn, M.O. (2018): "The Dynamic Effects of Personal and Corporate Income Tax Changes in the United States: Reply to Jentsch and Lunsford," Working Papers 1805, Federal Reserve Bank of Dallas.

- Milasi, S.,Waldmann, R. (2018): Top marginal taxation and economic growth, Applied Economics, 50(19), 2156-2170.

- Miller, S., Russek, F. (1997): Fiscal structures and economic growth: international evidence, Economic Inquiry, 35, 603-613.

- Moore, R., Bruce, D. (2014): Corporate income tax systems and state economic activity, Advances in Taxation, 21, 73-105.

- Mountford, A., Uhlig, H. (2009): "What are the effects of fiscal policy shocks?" Journal of Applied Econometrics 24(6), 960-992.

- Muinelo-Gallo, L., Roca-Sagalés, O. (2011): “Economic Growth and Inequality: The Role of Fiscal Policies,” Australian Economic Papers.

- Mullen, J., Williams, M. (1994): "Marginal tax rates and state economic growth", Regional Science and Urban Economics 24, 687-705.

- Myles, G.D. (2000): "Taxation and Economic Growth". Fiscal Studies 21, 141-168. 10.1111/j.1475-5890.2000.tb00583.x.

- Myles, G.D. (2009): "Economic Growth and the Role of Taxation-Theory", OECD Economics Department Working Papers 713, OECD Publishing.

- Nguyen, A.D.M., Onnis, L., Rossi, R. (2021): "The Macroeconomic Effects of Income and Consumption Tax Changes," American Economic Journal: Economic Policy 13(2), 439-466, May.

- Ojede, A., Yamarik, S. (2012): Tax policy and state economic growth: the long-run and short-run of it, Economics Letters, 116(2), 161-165.

- Padovano, F., Galli, E., Tax rates and economic growth in the OECD countries (1950-1990), 39 Economic Inquiry 44-57 (2001).

- Perotti, R., (2005): "Estimating the effects of fiscal policy in OECD countries", Proceedings, Federal Reserve Bank of San Francisco.

- Pjesky, R. (2016): "The impact of state corporate tax rate changes on state economic performance", Southwestern Economic Review, 43, 103-115.

- Prillaman, S., Meier, K. (2014): "Taxes, incentives, and economic growth: assessing the impact of pro-business taxes on U.S. state economies", Journal of Politics, 76(2), 364-379.

- Reed, R. (2008): "The robust relationship between taxes and U.S. state income growth", National Tax Journal 61, 57-80.

- Rhee, T. (2012): “Macroeconomic Effects of Progressive Taxation,” https://www.aeaweb.org/conference/2013/retrieve.php?pdfid=394.

- Romer, C. D., Romer, D.H. (2010): "The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks," American Economic Review, vol. 100(3), 763-801, June.

- Sanchez, A., Gori, F. (2016): "Can reforms promoting growth increase financial fragility? An empirical assessment", OECD Economics Department Working Papers No. 1340.

- Shevlin, T., Shivakumar, L., Urcan, O. (2019): "Macroeconomic effects of corporate tax policy", Journal of Accounting and Economics, 68(1), 101233.

- Suarez Serrato, J., Zidar, O. (2018): "The structure of state corporate taxation and its impact on state tax revenues and economic activity", Journal of Public Economics, 167(C), 158-176.

- Szarowska, I., (2010): "Changes in taxation and their impact on economic growth in the European Union," MPRA Paper 32354, University Library of Munich, Germany.

- Tanasie, M. (2020): "The Impact of Taxation on Growth: A Quantitative Analysis on a Panel Data of 24 OECD Countries". http://dx.doi.org/10.2139/ssrn.3580065

- Ten Kate, F., Milionis, P. (2019): "Is capital taxation always harmful for economic growth?", International Tax and Public Finance, 26(4), 758-805.

- Tomljanovich, M. (2004): "The role of state fiscal policy in state economic growth", Contemporary Economic Policy, 22(3), 318-330.

- Ufu, A., Grigsby, J.R., Nicholas, T., Stantcheva, S., 2018. “Taxation and Innovation in the 20th Century.” NBER Working Paper 24982.

- Widmalm, F. (2001): "Tax structure and growth: Are some taxes better than others?", Public Choice, 107(3-4), 199-219.

- Xing, J. (2012): "Tax structure and growth: How robust is the empirical evidence?", Economics Letters, 117(1), 379-382.

- Zidar, O., 2019, “Tax Cuts for whom? Heterogenous Effects of Income Tax Changes on Growth and Employment,” Journal of Political Economy 127(3), 1437-72.

Instituto +Liberdade

Em defesa da democracia-liberal.

info@maisliberdade.pt

+351 936 626 166

© Copyright 2021-2025 Instituto Mais Liberdade - Todos os direitos reservados

About Us

About Us